Consolidated FAQs on the implementation of Council Regulation No 833/2014 and Council Regulation No 269/2014

D. TRADE AND CUSTOMS

1. CUSTOMS-RELATED MATTERS

RELATED PROVISION: COUNCIL REGULATION 833/2014

1. Where can I find the list of the EU sanctions against the Russian Federation, the Republic of Belarus and non-government controlled areas of Ukraine?

Last update: 7 February 2023

Please refer to the EU sanctions map: www.sanctionsmap.eu.

Below you will find the list (last update 7 February 2023)

Russia

• Council Regulation (EU) No 833/2014 of 31 July 2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine – consolidated basic legal act (04/12/2022)

• Council Decision 2014/512/CFSP of 31 July 2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine – consolidated basic legal act (04/12/2022)

• Council Regulation (EU) 2022/2474 of 16 December 2022 amending Regulation (EU) No 833/2014 concerning restrictive measures in view of Russia’s actions destabilising the situation in Ukraine – amendment not yet in the consolidated basic legal act

• Council Decision (CFSP) 2022/2478 of 16 December 2022 amending Decision 2014/512/CFSP concerning restrictive measures in view of Russia’s actions destabilising the situation in Ukraine - amendment not yet included in the consolidated basic legal act

Belarus

• Council Regulation (EC) No 765/2006 of 18 May 2006 concerning restrictive measures in respect of Belarus – consolidated basic legal act (20/07/2022)

• Council Decision 2012/642/CFSP of 18 May 2006 concerning restrictive measures in view of the situation in Belarus – consolidated basic legal act (20/07/2022)

Restrictive measures in response to the illegal recognition, occupation or annexation by the Russian Federation of certain non-government controlled areas of Ukraine

• Council Regulation (EU) 2022/263 of 23 February 2022 concerning restrictive measures in response to the illegal recognition, occupation or annexation by the Russian Federation of certain non-government controlled areas of Ukraine – consolidated basic legal act (07/10/2022)

• Council Decision (CFSP) 2022/266 of 23 February 2022 concerning restrictive measures in response to the illegal recognition, occupation or annexation by the Russian Federation of certain non-government controlled areas of Ukraine – consolidated basic legal act (07/10/2022)

Restrictive measures in response to the illegal annexation of Crimea and Sevastopol

• Council Decision 2014/386/CFSP of 23 June 2014 concerning restrictive measures in response to the illegal annexation of Crimea and Sevastopol – consolidated basic legal act (22/06/2022)

• Council Regulation (EU) No 692/2014 of 23 June 2014 concerning restrictive measures in response to the illegal annexation of Crimea and Sevastopol – consolidated basic legal act (06/10/2022)

Restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine

• Council Decision 2014/145/CFSP of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine – consolidated basic legal act (14/11/2022)

• Council Regulation (EU) No 269/2014 of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine – consolidated basic legal act (14/11/2022)

Misappropriation of state funds of Ukraine (restrictive measures on the freezing and recovery of assets of persons identified as responsible for the misappropriation of Ukrainian State funds and persons responsible for human rights violations)

• Council Decision 2014/119/CFSP of 5 March 2014 concerning restrictive measures directed against certain persons, entities and bodies in view of the situation in Ukraine – consolidated basic legal act (05/03/2021)

Council Regulation (EU) No 208/2014 of 5 March 2014 concerning restrictive measures directed against certain persons, entities and bodies in view of the situation in Ukraine – consolidated basic legal act (13/09/2022)

2. Are there any specific instructions, guidance, and notices to importers?

Last update: 7 February 2023

The following notices have been published:

• Notice to importers: Imports of products into the Union from the Donetsk, Kherson, Luhansk and Zaporizhzhia oblasts of Ukraine, 2022/C 458/02, https://europa.eu/!3fnkVn

• Notice to importers: Imports of products into the Union under the EU-Ukraine Association Agreement from the non-government controlled areas of the Donetsk and Lugansk oblasts of Ukraine, 2022/C 87 I/01 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:C:2022:087I:FULL&from=EN

• Notice (2022/C 93 I/01) to importers on Imports into the Union of goods originating in the non-government controlled areas of the Donetsk and Lugansk oblasts of Ukraine You will find the https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52022XC0228%2805%29Notice to economic operators, importers and exporters, 2022/C 145 I/01, https://europa.eu/!rKWHmb

• See also the:

- Commission Communication: Providing operational guidelines for external border management to facilitate border crossings at the EU-Ukraine borders 2022/C 104 I/01, https://europa.eu/!pMtg4m

- Commission Guidance Note on the implementation of certain provisions of Regulation (EU) No 833/2014, https://europa.eu/!g3dHJK

The updated list of guidance, FAQs and notices are available here: Restrictive measures (sanctions) | European Commission (europa.eu).

3. Are there any border crossing points (customs offices) that are completely closed between the EU and Russia?

Last update: 1 June 2022

Please note the reply below may change daily.

Estonia

No closed Border Crossing Points (Customs Control Points) on the Estonian border with Russia.

Finland

No closed Border Crossing Points (Customs Control Points) on the Finnish border with Russia.

Latvia

No closed Border Crossing Points (Customs Control Points) on the Latvian border with Russia and Belarus.

Lithuania

LT/RU border: Ramoniškiai – Pograničnyj, Nida-Morskoje, Nida-Rybačij, Jurbarkas-Sovetskas, Rusnė-Sovetskas

LT/BY border: Adutiškis-Moldevičiai, Krakūnai-Geranainys, Eišiškės-Dotiškės, Rakai-

Petiulevcai, Norviliškės-Pickūnai, Latežeris-Pariečė, Švendubrė-Privalka

Poland

PL/RU border: Gronowo, Gołdap

PL/BY border: Kuźnica, Połowce, Slawatycze

Useful links - on-line border information, incl. waiting time:

POLAND

https://granica.gov.pl/index.php?v=en

HUNGARY

Frontpage | A Magyar Rendőrség hivatalos honlapja (police.hu)

https://www.police.hu/hu/hirek-es-informaciok/hatarinfo?field_hat_rszakasz_value=ukr%C3%A1n+hat%C3%A1rszakasz

SLOVAK REPUBLIC

https://www-financnasprava-sk.translate.goog/sk/infoservis/hranicnepriechody?_x_tr_sl=sk&_x_tr_tl=en&_x_tr_hl=en-US&_x_tr_pto=wapp

ROMANIA

https://www.politiadefrontiera.ro/en/traficonline

MOLDOVA

https://customs.gov.md/en/traffic

4. What does the “ex” mean before some CN codes in the annexes of Regulation 833/2014?

Last update: 26 July 2022

When a CN code is preceded by an “ex”, it means that not all goods under the relevant CN code are covered by the prohibition but only a subset, which can be those corresponding to the description that appears in the table, in the title or sub-title of the relevant annex or in the relevant article in the Regulation. For example, in Annex X, for CN Code 8419 89 10 “Cooling towers and similar plant for direct cooling (without a separating wall) by means of recirculated water”, only the goods falling under the description in the table as “Alkylation and isomerization units” are subject to the restrictions.

5. How should Member States’ authorities treat companies established in Russia when these carry out goods transiting between mainland Russia and the Kaliningrad region?

Last update: 13 July 2022

Please see Q&A 5 in the FAQs on “road transport”: transit of sanctioned goods by road is not allowed.

However, no such specific regime applies to rail transport on the same route, without prejudice to Member States’ obligation to perform effective controls as set out below, in conformity with EU law.

The transit of sanctioned military and dual use goods and technology, as defined in Regulation (EU) 2021/821, is prohibited in any event.

Member States must also ensure that sanctioned goods that have illegally arrived in any part of Russia cannot be transported onwards via the EU customs territory.

GOODS ENTERING INTO THE UNION

6. How importation of personal belongings of Ukrainians entering the Union, including pets and cash is cleared by customs authorities?

Last update: 24 March 2022

Articles 4 to 11 of Regulation (EC) No 1186/2009 of 16 November 2009 setting up a Community system of reliefs from customs duty can be used for processing the personal property of displaced persons from Ukraine. According to Article 11 of this 7 Regulation, the competent authorities may derogate from certain conditions limiting duty relief when a person has to transfer his normal place of residence from a third country to the customs territory of the Community as a result of exceptional political circumstances. As a consequence, personal belongings can be brought by displaced persons from Ukraine into the Union without any customs duties being applied. Customs declarations could also take a simplified form, including oral declaration.

Similarly, Articles 4 to 11 of Council Directive 2009/132/EC of 19 October 2009 determining the scope of Article 143(b) and (c) of Directive 2006/112/EC as regards exemption from value added tax on the final importation of certain goods can be used for the processing of the personal property of displaced persons from Ukraine. According to Article 11 of this Directive, the competent authorities may derogate from certain conditions limiting VAT exemption when a person has to transfer his normal place of residence from a third country to a Member State of the Community as a result of exceptional political circumstances. As a consequence, personal belongings can be brought by displaced persons from Ukraine into the Union without any VAT on importation being applied.

Article 32 of Regulation (EU) 576/2013 on the non-commercial movement of pet animals can be used for facilitating the entry of pet animals travelling with their owners from Ukraine. To ease this process and by way of derogation from the conditions provided for non-commercial movements of pet animals, Member States may authorise, in exceptional situations, the noncommercial movement into their territory of pet animals which do not comply with the said conditions under specific permit arrangements. Veterinary competent authorities in all Member States were already informed about this possibility and started to implement such arrangements at borders.

In the case of cash (currency, bearer negotiable instrument or commodities used as highly liquid stores of value, such as gold), the provisions on cash controls laid down in Regulation (EU) 2018/1672 would need to be applied to the extent possible under the specific circumstances. This could be done by declaring the cash carried of a value of EUR 10 000 or more, either via an incomplete cash declaration or simply via a self-declaration containing the following information: - Carrier of the cash with contact details, and - Amount of cash.

Nevertheless, at the point of entry into the Union, officers in charge of external border controls enquire and check if a person is in possession of a firearm.

You can find additional information here: Communication providing operational guidelines external border management EU-Ukraine borders_en_1.pdf

7. How to handle postal packages arriving from UA to the EU, containing the personal belongings of refugees being already in the EU, especially when the value is above 45 EUR?

Last update: 1 June 2022

Personal belongings of war refugees can be transferred to the customs territory of the Union without any customs duties and without usual limiting conditions being applied. Under the light of the provision of Article 7 of Regulation (EC) No 1186/2009 , duty relief for personal property shall be granted within 12 months from the date of establishment of place of residence of the refugees in question. Furthermore, the personal property may be released for free circulation in several separate consignments. The relief from import duty for personal belongings in accordance with Articles 4 to 11 of Regulation (EC) No 1186/2009 and the additional information already published is not limited to the way how the personal belongings are transported.

8. Does the import prohibition on wood and wood products also include wood products which are used exclusively for packaging or dispatch/transport purposes and are not the subject of commercial transactions, e.g. wooden pallets, wooden packaging boxes, used wooden cable drums?

Last update: 24 March 2022

The prohibitions apply to the product declared in customs for the considered procedure. For example, if copper cables coiled on wood spools are declared for release for free circulation, they are declared as copper cables and the prohibition on wood products does not apply. This is because the commercial object of the movement is the cables, not the spools. However, if empty wood spools are declared for release for free circulation, they are the object of the movement and therefore submitted to the prohibition.

9. Please explain the implementation of the sanctions on goods which, under the previous prohibitions could be imported and were dispatched from Belarus prior to the entry into force of the sanctions under Regulation 2022/355

Last update: 24 March 2022

Unless a sunset clause applies under the relevant prohibition (allowing the execution of contracts concluded before the entry into force of the sanctions for a prescribed period after that entry into force), the sanctions provided for in the above Regulation shall apply for goods that at the time of entry into force of the Regulation:

- had been dispatched from Belarus for carriage into the EU and were en route

- were under temporary storage in the customs territory of the EU

However, if the goods have been released for free circulation before the entry into force of Regulation 2022/355, the sanctions do not apply.

Where a sunset clause applies, the same treatment will be applicable to goods under sanctions as of the date of expiry of the wind-down period.

10. What is the legislation applicable on customs and taxation in particular, on horses that are evacuated from the war in Ukraine?

Last update: 24 March 2022

Animals can be declared for temporary admission in the Union as long as they fulfil the conditions mentioned in the relevant legislation, especially Article 251(2) of the Union Customs Code (UCC), e.g. they stay in the customs territory of the Union for a certain period of time without undergoing any change except normal depreciation to the use made of them. The time limit of the customs procedure cannot be shorter than 12 months (Article 237(2) UCC-DA ), which does not mean that the horses must stay at least 12 months in the EU. This time limit cannot exceed 24 months, but it can be extended in exceptional circumstances; in consequence the total period of the customs procedure cannot be longer than 10 years (paragraphs 2 to 4 of Article 251 UCC).

If the horses are in temporary admission they may be covered by an ATA carnet, but they can also be covered by a standard customs declaration.

The importer can be established in the customs territory of the Union and the horses would benefit from relief from import duty (Article 223 UCC-DA).

In the case of temporary importation arrangements, Article 71(1) of the VAT Directive could apply, meaning that the chargeable event will only take place when the horses cease to be covered by those arrangements. In other words, as long as the horses remain under the temporary importation arrangements, no VAT is due.

11. Can I import under the preferences of the EU-Ukraine Association Agreement from the regions of Donetsk and Luhansk?

Last update: 7 February 2023

For the most recent information on this topic, please see Question no. 2 in the “Donetsk, Kherson, Luhansk and Zaporizhzhia oblasts” FAQ.

12. We would like to ask the Commission whether the entry into a free zone of goods related to persons/entities listed in annex I of Council Regulation (EU) No 269/2014 is still possible and if so, whether there are special circumstances or conditions linked to such entry, in light of the sanctions?

Last update: 1 June 2022

The entry into a free zone of goods related to persons/entities listed in Annex I of Council Regulation (EU) 269/2014 entails a movement of such goods, which for example once in the free zone can be sold to another person without moving them and thus would run counter to the freezing of economic resources. Therefore, the entry of such goods in a free zone is not allowed as it would lead to breach of Article 2 and Article 1(d) and (e) of that Regulation. This includes the goods related to persons/entities listed in Annex I of Council Regulation (EU) 269/2014, as well as its subsequent amendments.

13. Until the adoption of the 11th sanctions package, Article 3j of Regulation (EU) No 833/2014 prohibited to purchase, import, or transfer, directly or indirectly, coal and other solid fossil fuels, as listed in Annex XXII into the Union if they originate in Russia or are exported from Russia. Have these restrictions been lifted? Does this prohibition applies to all CN-codes previously mentioned in the Annex XXII? Regardless, if: a) the products are coal-based or not? b) the products are solid or not?

Last update: 26 July 2023

As explained in recital 51 of Council Regulation 1214/2023 of 23 June 2023 (“11th sanctions package”), Article 3j and Annex XXII were deleted because the prohibition concerning coal imports is covered by Article 3i and Annex XXI of Regulation (EU) No 833/2014. The prohibition is therefore still in force, though under a different legal provision. Additionally, the deletion of the transitional period under Article 3j which had already expired is not intended to have any legal effects on past or ongoing contracts or on the applicability of those transition periods.

The product scope subject to the restrictions previously laid down in Article 3j of Regulation (EU) No 833/2014 were defined in the former Annex XXII and applied to all CN-codes mentioned in the Annex. They are now defined in Annex XXI.

“Coal and other solid fossil fuels” in the former Article 3j was only a title, a denomination to distinguish a specific domain of the bans. It did not define, limit or expand the product scope defined in the former Annex XXII.

Similar examples are:

• The title of the former Annex XXII was "Coal products" but this does not limit the ban to products obtained from coal (ex: peat, lignite);

• Tar is not a fuel by itself and is not always a coal product, nor is it a solid fossil. Yet, 2706 "Tar distilled from coal, from lignite or from peat..." was fully included in the product scope of the former article 3j and is now covered by the scope of article 3i.

GOODS MOVING FROM THE UNION

14. When presenting and declaring such consignments with humanitarian aid at the border, are the donation declaration and the transport document sufficient for customs office or should the carrier still have on him a detailed list with a minimum of information of the goods: description, quantity, value?

Last update: 25 April 2022

The Union Customs Code is silent about the need to request any accompanying documents for oral export declarations. However, the customs authorities may perform the customs controls they consider necessary until they are taken out of the customs territory of the Union (see Articles 46(1) and 267(1) UCC). Therefore, the customs officials at the border, depending on the risk assessment, may not need to require any specific document on a systematic basis, but they have always the possibility to do some documentary controls if they choose to do so. Any documents are valid in that respect.

15. How customs should provide a proof of exit of goods for the purposes of tax exemption or tax deduction, e.g. in case where a company would like to send its own goods (produced or marketed by that company) to Ukraine as donation? Is an oral declaration sufficient or would it be necessary that a written customs declaration is submitted in any case for these consignments?

Last update: 25 April 2022

The supply of goods dispatched or transported to a destination outside the EU by or on behalf of the vendor is exempted from VAT in accordance with Article 146(1)(a) of the Council Directive 2006/112/EC (VAT Directive). The conditions to benefit from such VAT exemption at export and the means that can be accepted as evidence for the exit of the goods, are defined in the national VAT legislation. It is likely that an oral declaration in itself is not sufficient and the customs office competent for the place where the goods leave the customs territory of the EU needs to certify the exit of the goods.

16. Should containers coming from third countries that travel to Russia through an EU port be checked just as containers originating from the EU?

Last update: 24 March 2022

Yes, containers coming from 3rd countries that travel to Russia through an EU port be should checked. The Article 2 of the Council Regulation (EU) No 833/2014 concerning restrictive measures in view of Russia's actions destabilising the situation in Ukraine indicates that the sanctions apply to goods “whether or not originating in the Union”.

17. What should be done with ships under the flag of a 3rd state (e.g. South Africa), that travel to Russia via an EU port? Should these containers be checked as for EU originating containers?

Last update: 24 March 2022

The flag of the vessel does not make a difference. The rule is: Any consignment of goods, coming from third country and destined to Russia (directly or indirectly), has to be subject to a risk analysis and controls have to be carried out, where appropriate.

18. What is the rule for containers for which our customs has given their green light before the entry into force of the regulations imposing sanctions, but that have not yet left the port?

Last update: 24 March 2022

The sanctions apply whilst the goods are under customs supervision, i.e. they are not released for exit. Art. 333(1) Union Customs Code Implementing Act goes even further by stating: “1. Once goods have been released for exit, the customs office of exit shall supervise them until they are taken out of the customs territory of the Union”. i.e. basically the goods remain under customs supervision as long as they are still in the port.

If the goods are still under customs supervision (leaving for transit, export, etc.), customs can carry out any control or take any measure they deem necessary to rectify a situation that may have changed in the meantime (goods concerned, conditions of the prohibition/sanction etc.).

19. What is the effect of these sanctions on goods originating from a non-EU jurisdiction that are transiting through a Member State with Russia as final destination? Do the measures apply for transhipments via an EU country?

Last update: 24 March 2022

Goods located in the EU having Russia as a final destination, and which are included in the sanctions list, fall under the scope of Article 2, 2a and 2b of Council Regulation 833/2014. The prohibition to sell, supply, transfer or export these goods, directly or indirectly, includes the prohibition to transit via the EU territory. Transit of prohibited goods between third countries across an EU country is thus prohibited.

External transit, transhipment, reshipment, re-exported from a free zone, temporary stored and directly re-exported from a temporary storage facility, introduced into the customs territory of the Union on the same vessel or aircraft that will take them out of that territory without unloading, and any other movement of goods entering in the EU and are destined to Russia, will be subject to the risk assessment by the customs authorities, which can decide whether the consignment is in the scope of the sanctions and therefore needing a control. These goods would be under customs supervision until they exit the customs territory of the Union (see Article 267(1) of Regulation (EU) No 952/2013 of the European Parliament and of the Council, of 9 October 2013, laying down the Union Customs Code).

20. What is to be understood by “item”?

Last update: 24 March 2022

Item is to be understood as the “supplementary unit” in the export declaration (data element 18 02 000 000 or 6/2 or Box 41 of the SAD). Customs legislation defines the supplementary unit as the quantity of the item in question, expressed in the unit laid down in Union legislation, as published in TARIC.

For goods that do not have a supplementary unit in TARIC, the information on “number of packages” (data element 18 06 004 000 or 6/10 or Box 31 of the SAD) could be used to check the threshold. Customs legislation defines packages as the smallest external packing unit. The number of packages to be stated in an export declaration refers to the individual items packaged in such a way that they cannot be divided without first undoing the packing, or the number of pieces, if unpackaged. The codes to be stated follow the UNECE recommendation on the matter. The UNECE recommends recording the “immediate wrapping or receptacle of the goods, which the purchaser normally acquires with them in retail sales”.

Accordingly, an item means usual packaging for retail sale, e.g. a package of 3 bottles of perfume if they are sold together, or a bottle of perfume if it is meant to be sold separately.

Pursuant to Article 15 of the Union Customs Code, the persons providing information to the customs authorities are responsible for the accuracy and completeness of the information provided. If necessary, the customs authorities may require additional information (invoices, physical controls) to verify the information stated in the customs declaration and whether or not the threshold is reached.

21. Point 17) of Annex XVIII refers to a list of vehicles and appliances and “accessories and spare parts” of those. What is the scope of “accessories and spare parts”? Does it apply to accessories and spare parts of vehicles of a value of EUR 50 000 or below? What is the value threshold applicable to these accessories and spare parts?

Last update: 5 May 2022

Article 3h of Council Regulation (EU) No 833/2014 as amended by Council Regulation (EU) 2022/428 of 15 March 2022 provides for the prohibition to sell, supply, transfer or export goods listed in Annex XVIII of the same Regulation to any natural or legal person, entity or body in Russia or for use in Russia. The same article establishes that such a prohibition shall apply to the goods listed insofar as their value exceeds EUR 300 per item unless otherwise specified in the Annex.

Point 17) of Annex XVIII refers to vehicles, except ambulances, for the transport of persons on earth, air or sea of a value exceeding EUR 50 000 each, teleferics, chairlifts, ski-draglines, traction mechanisms for funiculars, motorbikes of a value exceeding EUR 5 000 each, as well as their accessories and spare parts.

In relation to the accessories and spare parts, the above mentioned provision and annex should be applied as follows:

• accessories and spare parts of a value of or below EUR 300 per item are not subject to the restrictions provided for in Article 3h

• accessories and spare parts listed in point 17 of Annex XVIII of a value exceeding EUR 300 that are not intended for the use of the vehicles and appliances also listed there are not subject to the restrictions provided for in Article 3h. This means, i.e. that the prohibition does not apply to accessories and spare parts of vehicles of a value of EUR 50 000 or below.

• accessories and spare parts listed in point 17 of Annex XVIII of a value exceeding EUR 300 that are intended for the use of the vehicles and appliances listed there are subject to the restrictions provided for in Article 3h.

22. The transportation and insurance costs are to be included in the customs value. This is very complicated to apply in practice. For every truck, the transport cost will be very different. How we can adjust the transfer price to include the transport costs, particularly when there are different components in one same truck? How is the EUR 300 value to be assessed?

Last update: 25 April 2022

While goods are exported, a declarant is obliged to provide the customs authorities with the information on statistical value for the goods. This obligation exists regardless of the fact whether the exported goods are subject to any restrictions or not.

The relevant provisions on statistical value (Commission Implementing Regulation (EU) 2020/1197 of 30 July 2020) do not regulate the issue of allocation of transportation and insurance costs while the statistical value at exportation is to be established.

Nevertheless, EUCDM GUIDANCE DOCUMENT provides explanations in this respect (link: EUCDM Guidance). In accordance with the GUIDANCE, “The statistical value must include only ancillary charges. These are the actual or calculated costs for transport and, if they are incurred, for insurance, but covering only that part of the journey which is within the statistical territory of the exporting Member State. If transport or insurance costs are not known, they are to be assessed reasonably on the basis of costs usually incurred or payable for such services (considering especially, if known the different modes of transport). (…) If the ancillary costs relate to several items on an export declaration, the respective ancillary costs for each individual item must be calculated on a relevant pro rata basis, e.g. kg or volume.”

23. Whether iron tubes under CN code 73079100 can or cannot be exported from the EU to a Russian company that is not on the sanctions list. Whether the goods with the CN code 73079100 can fall within the scope of dual-use goods under Council Regulation (EC) No 428/2009 and Regulation (EU) 2021/821 or whether all goods related to the energy sector now need an authorisation?

Last update: 25 April 2022

Currently (28 March 2022), CN code 7307 91 00 is not listed in any export ban to Russia or in the correlation table of the dual-use regulation (Regulation (EU) 2021/821).

However, the provisions of the dual-use regulation apply mutatis mutandis to the recent amendments of Regulation 833/2014 (See Regulation (EU) 2022/328). This means notably that, by virtue of the dual-use "catch-all" provisions, the competent authorities can require an authorisation also on goods not listed in the regulations, even for a company not listed in the sanctions list.

24. Whether the Council Regulation (EU) 2022/355 of 2 March 2022 shall be applied on goods in outward processing customs procedure at the territory of Belarus, even all components used for that processing are from the EU and the final products are reimported into the EU?

Last update: 25 April 2022

Restrictions imposed for exports to Belarus go beyond the ‘standard’ export as per the meaning of the Union Customs Code and thus covering goods sent to Belarus under outward processing as well. However, the restriction for export is applying only to the goods as specified in the amended (EC) No 765/2006. Cylinders (Combined Nomenclature code 73) are not in the list of goods restricted under Article 1s and Annex XIV. However, in order to know whether the specific cylinders are subject to the restrictions envisaged in the other Articles for export of dualuse goods (Annex V(a) of Regulation) the exact CN code is necessary.

Nevertheless, with regard to import, all Articles of iron and steel (Combined Nomenclature (CN) code 73) are subject to the restrictions imposed by Article 1q, unless they fall within the derogation envisaged in paragraph (2): ’The prohibitions in paragraph 1 shall be without prejudice to the execution until 4 June 2022 of contracts concluded before 2 March 2022, or ancillary contracts necessary for the execution of such contracts.’

25. As the sanctions apply to special procedures including re-export, what would be the next steps for person responsible (holder of procedure) in relation to the ongoing special procedure, taking into account the deadlines for discharge?

Last update: 1 June 2022

The holder of the authorisation can request to the supervising customs office the extension of the time limit to discharge the special procedure. If, despite the extension granted, the holder of the authorisation cannot meet the deadline, he/she can ask for the application of Article 120 UCC, i.e. remission or repayment of the import duty in special circumstances (equity). Such case would need to be carefully considered on a case by case basis.

VARIOUS

26. Is it possible that temporary storage is extended to 6 months instead of 90 days, extendable depending on the progress of the conflict?

Last update: 24 March 2022

Despite the crisis due to the situation in Ukraine, the Union Customs Code (UCC) does not provide for any derogation on the extension of the 90-day time limit established in Article 149 UCC. A solution to this problem, as it was proposed in the COVID guidance, is that the holder of the authorisation for the temporary storage facilities applies to obtain an authorisation for customs warehouse for these facilities (or part of them) and in this manner there would not be time limit to have the goods stored under the customs warehousing procedure. If, despite the implementation of this solution, some goods cannot meet the 90-day time limit, the concerned economic operators may request force majeure and the customs authorities may apply Article 120 UCC (equity).

27. Please confirm if discharge of temporary storage after 90 days by placing the goods under embargo under the special procedure of customs warehouse would not be contradictory to the definition of customs warehouse which explicitly excludes goods under prohibition of entry or exit into or from the customs territory of the Union? (see Article 237 (1) (c) UCC)

Last update: 25 April 2022

The 90-day time-limit for temporary storage as referred to in Article 149 Union Customs Code (UCC) cannot be extended without amending the UCC. A possible solution to keep the goods in the storage facility is that the holders of the authorisations of the temporary storage facilities apply for an authorisation for customs warehouse facilities, so that the goods introduced in in such facilities are not subject to any time limit.

The abovementioned solution is not affected by Article 237(1)(c) UCC because the sanctions to

Russia and Belarus are not commercial policy measures as they do not stem from Article 207 TFEU. Therefore, this solution is a feasible alternative to store the goods that are likely not to comply with the 90-day time limit established in Article 149 UCC. The same applies for goods placed under transit and temporary admission as the Articles you mention also refer to commercial policy measures.

28. Can you confirm that postal flows are subject to the same restrictive measures as other export flows?

Last update: 24 March 2022

The provision of universal postal services is at global level, in principle, governed by the acts of the UPU – the Universal Postal Union. The UPU Constitution guarantees the free circulation of the mail across the single postal territory of the Union (192 member countries), which is realized by the interconnection of all national postal networks of the member countries. All EU Member States are UPU members. As such, they have ratified the UPU acts, so they are obliged to adhere by them. Furthermore, there is no contrary provision to this element in the EU Postal Services Directive.

However, certain items are prohibited from being sent by post, such as dangerous goods, illicit drugs or any “items sent in furtherance of a fraudulent act or with the intention of avoiding full payment of the appropriate charges”. Furthermore, every member country of the Universal

Postal Union has the option to add to these prohibitions. At the same time, the relevant EU Council Regulations and Decisions are directly applicable in all Member States and both prohibit postal users from sending such items, as well as postal service providers from providing postal services for such items.

While the restrictive measures do not apply to postal services as such, which can continue as long as transport is available, the goods under restrictive measures can in essence be considered as prohibited items and cannot therefore be sent by post.

29. Do the sanctions provided by Regulation (EU) No 833/2014 only concern “dual use” items or are these also extended to other products? Are EU-based companies allowed to export food items or agricultural and horticultural products? Moreover, dual use goods have CAS numbers, which complicates matters.

Last update: 25 April 2022

The bans on export to Russia, defined in Regulation (EU) No 833/2014, concern indeed notably dual-use items but are not limited to these items. Chapters 01 to 24 are less impacted by the bans than the industrial chapters. However, export bans do exist for these chapters. They concern mainly luxury goods classified in these chapters and can impact food items (see article 3h and Annex XVIII of Regulation (EU) No 833/2014).

For information pertaining to derogations to the export ban of food items and more generally to humanitarian derogations, please refer to our dedicated Q&As document. Please note that humanitarian derogations do not apply to export of luxury goods.

We fail to see how the presence of a CAS code for dual-use items complicates the export formalities. If the question needs to be investigated further, more details on the problem mentioned need to be provided.

Guidance has been published and can be found at the following addresses:

• https://ec.europa.eu/taxation_customs/customs-4/international-affairs/eu-measuresfollowing- russian-invasion-ukraine_en

• https://trade.ec.europa.eu/doclib/docs/2022/march/tradoc_160079.pdf

• https://ec.europa.eu/info/business-economy-euro/banking-and-finance/international- relations/restrictive-measures-sanctions/sanctions-adopted-following-russias-militaryaggression- against-ukraine_en

• https://www.sanctionsmap.eu/#/main

Moreover, the “Export Control Handbook for Chemicals” is a useful tool to know what chemicals are subject to export controls by various regulations (Dual-use, explosive precursors, drug precursors, chemicals under restrictions for Syria, hazardous chemicals, etc.). The 2022 revision of the handbook will be published very soon. In the meantime the version 2021 can be downloaded. https://publications.jrc.ec.europa.eu/repository/handle/JRC124421

30. As per Regulation (EU) 2022/238, no reference to specific TARIC codes is made in relation to dual use goods or export prohibition. As per Regulation (EU) 2022/1, which is amendment to Annex I of Regulation (EU) 2021/821, list downs all applicable items under dual use regulation in detail, but we are unable to correlate it directly with TARIC codes. Would be possible to have a clarification of the TARIC codes concerned by EU Regulation2022/238?

Last update: 25 April 2022

Indeed CN codes for dual-use items are not published in the Official Journal. However, DG TAXUD has published a correlation table between CN codes and dual-use codes. This table lists all CN codes submitted to controls on dual-use items and therefore also submitted to the bans on exports to Russia.

The fact that the goods mentioned in your message are not dual-use items does not mean per se that they are free from the export bans.

These export bans cover a wider product scope than dual-use items and it is advised referring to the information page published by the European Commission for more information on the product coverage.

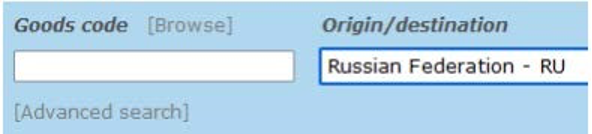

If the CN codes of the products are known, the sanctions can also be found on the TARIC web site.

Enter "Russia" in the "origin/destination" field and the CN code in the "good code" field.

The Commission does not publish lists of CN codes per regulation. However, if you wish to display all codes impacted by a specific legal act (in this case, Regulation (EU) 2022/328), click on "advanced search" to display the full query screen, and enter the reference of the legal act in the field "Legal base".

31. Please clarify, whether Russian cultural goods which are temporarily imported into the Union (e.g. international lending between museums for the purpose of exhibitions) could return to their rightful owners in Russia?

Last update: 1 June 2022

There would be no requirement to obtain an export licence in this case, as the goods are – by definition – not definitively located in a Member State (Article 2(2) of Regulation 116/2009).

As regards sanctions, please note that the Council has adopted on 8 April Regulation (EU) 2022/576, as an amendment to Council Regulation 833/2014, in order to allow the re-export to Russia of cultural goods which are on loan in the context of formal cultural cooperation with Russia. Should the artworks be considered as under a loan in the context of a formal cultural cooperation with Russia, their return to Russia should be possible, subject to, the authorisation of the competent national authority for sanctions.

On this matter, we would suggest you contact your national authority. Please see its contact details in the list available here:

https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/docum ents/national-competent-authorities-sanctions-implementation_en.pdf

For the sake of completeness, we should mention the possibility - however remote - that a cultural good temporarily admitted in the Union could be nevertheless retained here and not allowed to return to Russia: that would the case where the owner of the good is a Russian national against whom the Union has taken measures of freezing of assets.

32. What is the customs procedure for people who are living very close to the border and who are daily crossing the Russian border (e.g. people visiting relatives on the other side of the border, people having a property in Russia, people who travel regularly because of work)? How should we interpret personal use of banknotes denominated in any official currency of a Member State in their case?

Last update: 1 June 2022

The prohibitions stipulated in article 5i of regulation (EU) No 833/2014 apply regardless of the personal or professional situation of the persons carrying the cash.

Regular travellers are submitted to the same provisions. The derogation to the cash export ban for personal use by virtue of article 5i.2(a) allows the travellers to carry cash only for the necessities of the travel and the travellers accompanying them. This exemption does not allow them to bring cash for other recipients in Russia.

Please note that, independently from the above, the travellers must submit a cash declaration to the national customs authorities, in cases where a declaration must be submitted in accordance with the provisions of the cash controls Regulation (Regulation (EU) 2018/1672)

33. What is meant by the definition of agricultural products? Is this limited to goods obtained through agriculture? Or does it equally concern agricultural machinery

Last update: 1 June 2022

Article 38 of the TFEU provides the definition of “agricultural products”, i.e.: “Agricultural products means the products of the soil, of stock-farming and of fisheries and products of first stage processing directly related to these products “. Please refer to Annex 1 to the TFEU “LIST REFERRED TO IN ARTICLE 38 OF THE TREATY ON THE FUNCTIONING OF THE EUROPEAN UNION” for more details.

Taking into account the above text, Agricultural products should not be considered as covering agricultural machinery.

34. What does it mean when a CN-code in one of Annexes of Regulation (EU) 833/2014 is preceded by an “ex”?

Last update: 29 June 2022

When a CN-code is preceded by an “ex” it means that not all goods under the relevant CN-codes are covered by the prohibition, but only a subset, which can be those corresponding to the description that appears in the table, in the title or sub-title of the relevant annex or in the relevant article in the Regulation. For example, in Annex X of Regulation (EU) 833/2014 the goods covered under CN-Code 8419 89 10 “Cooling towers and similar plant for direct cooling (without a separating wall) by means of recirculated water” only the goods falling under the description in the table as “Alkylation and isomerization units” are subject to the restrictions.

2. EXPORT-RELATED RESTRICTIONS FOR DUAL-USE

GOODS AND ADVANCED TECHNOLOGIES

RELATED PROVISION: ARTICLE 2; ARTICLE 2a; ARTICLE 2b OF COUNCIL REGULATION 833/2014

1. What is the purpose of this Guidance and how do the new export restrictions in the Sanctions Regulation relate to existing sanctions against Russia?

Last update: 2 October 2023

Council Regulation (EU) 2022/328 of 25 February 2022 , Council Regulation (EU) 2022/345 of 1 March 2022, Council Regulation (EU) 2022/394 of 9 March 2022, Council Regulation (EU) 2022/428 of 15 March 2022, Council Regulation (EU) 2022/576 of 8 April 2022, Council Regulation (EU) 2022/879 of 3 June 2022, Council Regulation (EU) 2022/1269 of 21 July 2022, Council Regulation (EU) 2022/1904 of 6 October 2022, Council Regulation (EU) 2022/2474 of 16 December 2022, Council Regulation (EU) 2023/427 of 25 February 2023 and Council Regulation (EU) 2023/1214 of 23 June 2023 build on, and expand, the EU restrictive measures (sanctions) in form of export restrictions under the Sanctions Regulation .

This Guidance aims at supporting competent authorities and stakeholders, including exporters, in the implementation of the export restrictions introduced in Articles 2, 2a and 2b and the related provisions in Articles 1, 2c and 2d of the Sanctions Regulation, without prejudice to that regulation or of other regulations.

2. What does the Sanctions Regulation do in the area of export restrictions, including export controls for dual-use and advanced technologies?

Last update: 10 October 2022

Firstly, the Sanctions Regulation has expanded the scope of export restrictions concerning dualuse goods and technologies as identified in Annex I of the EU Dual-Use Regulation . The export of these items has been prohibited since 2014 for the military sector. Now the prohibition applies even when these items are intended for civilian end-users or uses, with very limited exemptions and derogations.

Secondly, the Sanctions Regulation also prohibits the export of additional ‘Advanced Technology’ items to limit the enhancement of Russia’s military and technological capacity in sectors such as electronics, computers, telecommunications and information security, sensors and lasers marine, chemicals that could be used in the process of manufacture of chemical weapons, special materials and related equipment, manufacturing equipment and other sensitive items, such as those used by law enforcement bodies.

Thirdly, the Sanctions Regulation identifies entities connected to Russia’s defence and industrial base, on whom even tighter export restrictions are imposed.

As in other EU sanctions regimes, the export restrictions apply to the sale, supply, transfer and export of covered items, as well as the provision of brokering services and of technical and financial assistance.

The new provisions foresee very limited exemptions and derogations in certain defined situations further explained in this document. Similarly, the Sanctions Regulation allows for some possibility of continuing exporting under pre-existing, or “grandfathered” contracts, subject to an authorisation by the competent authority.

Lastly, the Sanctions Regulation contains other export restrictions e.g. an export ban for goods and technology suited for use in aviation or the space industry as well as in the energy sector, for luxury goods, on maritime navigation goods and technology and on goods which could contribute in particular to the enhancement of Russian industrial capacities. These measures are not covered by this FAQ.

3. I am an exporter selling products to Russia. How can I verify that I am allowed to export the product and whether it requires any prior authorisation?

Last update: 10 October 2022

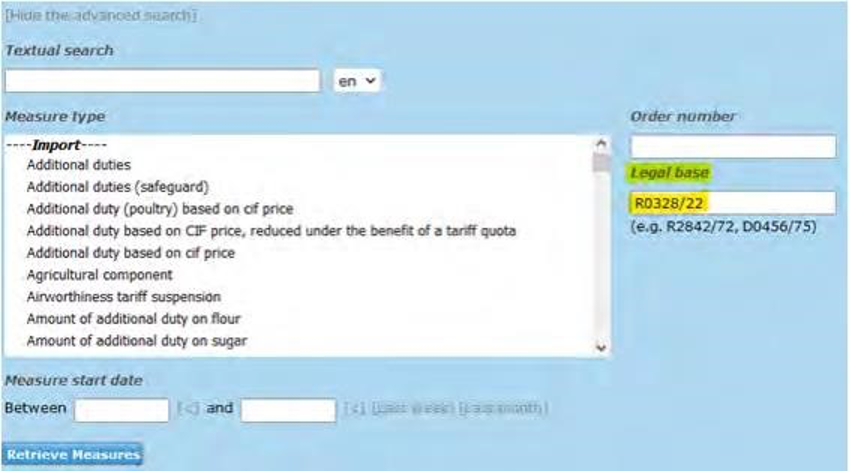

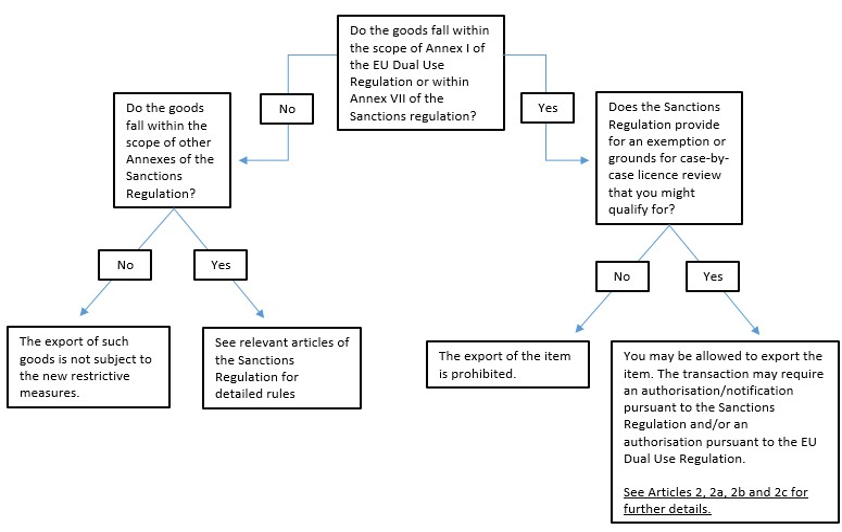

In simplified terms, the process for verifying if you are concerned by an export restriction is the following:

This is a simplified diagram. For further clarification, please check with the relevant competent authorities of your Member State whether the Sanctions Regulation (or other restrictions) apply to the product you are selling to Russia.

Certain Annexes to the Sanctions Regulation, for example Annexes II, X, XI, XVIII and XXIII, include codes of the Combined Nomenclature (CN), while dual-use items and advanced technology items listed in Annex VII are identified with technical descriptions. As part of its compliance obligations, the economic operator must verify, based on the CN code or the technical description, whether an item to be exported is covered or not. The fact that the CN code corresponding to an item is not listed in the Sanctions Regulation does not exclude that certain items classified under that CN code are affected because they may be dual-use items or those of Annex VII to the Sanctions Regulation, in accordance with Articles 2, 2a and 2b. As regards dual-use items and those of Annex VII of the Sanctions Regulation, there is no correlation in the Sanctions Regulation between the CN codes and such items subject to the restrictive measures.

4. The new measures take the form of “prohibitions”: is there now a total ban of exports to Russia for dual-use and ‘Advanced Technology’ items?

Last update: 10 October 2022

The export restrictions applicable to items covered by Annex I to the EU Dual-Use Regulation and to ‘Advanced technology’ items take the form of prohibitions but there are limited exemptions and derogations. Exemptions according to Article 2(3) and Article 2a(3) cover, among others, humanitarian needs, health emergencies, natural disasters, medical and pharmaceutical uses, temporary exports of equipment for use by news media and items for personal use. Derogations according to Article 2(4) and Article 2a(4) cover, among others, exports intended for government-to-government cooperation, exports intended for civilian nonpublicly available electronic communications networks which are not the property of an entity that is publicly controlled or with over 50% public ownership, exports for the operation, maintenance and safety of civil nuclear capabilities, or exports intended for companies owned, or solely or jointly controlled by an EU entity or the entity of a partner country, exports covered by prior contracts and items ensuring cyber-security and information security.

These exemptions and derogations are not available for export to individuals or entities connected to Russia’s defence and industrial base, as listed in Annex IV. For these entities, export is only permitted under the conditions specified in Article 2b(1)(a) and (b).

In parallel, it should be noted that the exemptions and derogations mentioned above are also not available for exports for the energy sector and for aviation or space industry except if they are intended for intergovernmental cooperation in space programmes.

5. What happened to EU exports to Russia on the day when the measures entered into force, if they were caught under the Sanctions Regulation?

Last update: 16 March 2022

The export restrictions entered into force and became fully applicable on 26 February 2022.

From that date, exports of goods and technology subject to the export restrictions introduced by the Sanctions Regulation are only allowed if permitted under (i) relevant exemptions, or (ii) derogations subject to authorisation. If an authorisation is required, until such an authorisation is granted, trade may not proceed.

6. What happened to EU exports to Russia on the day when the measures entered into force, if they were not caught under the Sanctions Regulation?

Last update: 16 March 2022

If the items are not covered by the Sanctions Regulation, they may be sold, supplied, transferred or exported to Russia without restrictions and the related provision of technical and financial assistance may continue. This is without prejudice to any other trade restrictions that might be in place under other provisions of the Regulation or under other regulations.

7. How does the Sanctions Regulation relate to the existing Dual-Use Regulation? Does it supersede it? Do both continue to apply?

Last update: 10 October 2022

The Sanctions Regulation applies “without prejudice” – i.e. in parallel – to the EU Dual-Use Regulation (EU) 2021/821. Exporters must ensure they comply with both regulations.

Consequently, the export of dual-use items might require an authorisation under the EU DualUse Regulation and, where a derogation applies under the Sanctions Regulation, also under that regulation. In case of doubt, exporters should contact the competent authority of the Member State where the exporter is resident or established.

In case the export of a dual-use item or an ‘Advanced technology’ item in Annex VII falls under the scope of an exemption according to Articles 2(3) and 2a(3), no prior authorisation is required under the Sanctions Regulation. For dual-use items, however, an authorisation might still be required under the EU Dual-Use Regulation.

For authorisations for goods and technology listed in Annex VII of the Sanctions Regulation, the rules and procedures laid down in the EU Dual-Use Regulation apply, mutatis mutandis. This means, for example, that when the export of an item not listed under Annex I of the Dual-Use Regulation is subject to an authorisation requirement under the EU Dual-Use Regulation, for example under Article 4 (so-called ‘catch-all’ clauses), such authorisation requirements remain in place, notwithstanding the fact that the same item may be listed in Annex VII to the Sanctions Regulation.

8. How does the ‘catch-all’ rule in the EU Dual-Use Regulation apply for entities listed in Annex IV of the Sanctions Regulation?

Last update: 16 March 2022

The export of dual-use items for military use and end-users is prohibited under the Sanctions Regulation. The export of items not listed in Annex I to the EU Dual-Use Regulation may still be subject to control under the “catch-all clause” of the EU Dual-Use Regulation, i.e. to ensure that they are not for military uses or end-users (including where the export concerns individuals or entities listed on Annex IV to the Sanctions Regulation).

9. What restrictions apply to the provision of technical assistance and brokering services?

Last update: 16 March 2022

The definition of ‘technical assistance’ and ‘brokering services’ can be found in Articles 1(c) and 1(d) of the Sanctions Regulation. The provision of such assistance or services falls under the prohibitions in Articles 2(2) and 2a(2) and it may be subject to the exemptions and derogations pursuant to Articles 2(3) and 2a(3), Articles 2(4) and 2a(4) and Articles 2(5) and 2a(5).

10. What information should be provided for notification and request for authorisation purposes for exports of dual-use or advanced technology items and the related technical assistance subject to exemptions or derogations under the Sanctions Regulation?

Last update: 10 October 2022

The notification to the competent authority and the request for authorisation shall – whenever possible - be submitted by electronic means. Annex IX to the Sanctions Regulation provides forms containing the mandatory elements for these notifications or applications and whenever possible, exporters should use these forms. However, when the use of the form is not possible, exporters shall provide at least all the elements described in the form and in the order provided set out in the forms.

If the item is covered by the EU Dual-Use Regulation, exporters must also submit the form(s) pursuant to that Regulation to the competent authority.

The notification/application/authorisation form in Annex IX to the Sanctions Regulation only refers to the provisions of Articles 2, 2a and 2b. It does not affect the use of forms related to other provisions of the Sanctions Regulation.

11. The item I am planning to export is not a dual-use item, nor is it included in Annex VII to the Sanctions Regulation. However, it includes a component listed in Annex I of the EU Dual-Use Regulation or in Annex VII to the Sanctions Regulation. Am I concerned by the export restrictions?

Last update: 10 October 2022

Non-controlled items containing one or more components listed in Annex VII are not subject to the export restrictions applicable to the export of these components, provided that the transaction is not intended to circumvent rules on dual-use export control or the restrictions on dual-use and ‘Advanced technology’ items pursuant to the Sanctions Regulation.

However, non-controlled items containing one or more components listed in Annex I of the EU Dual-Use Regulation may still be subject to export controls under the so-called ‘principal elements rule’ (point 2 of the General Notes to Annex I of the EU Dual-Use Regulation). This means that the object of the controls contained in Annex I may not be defeated by the export of any non-controlled goods containing one or more controlled components when the controlled component or components are the principal element of the goods and can feasibly be removed or used for other purposes. In judging whether the controlled component or components are to be considered the principal element, it is necessary to weigh the factors of quantity, value and technological know-how involved and other special circumstances which might establish the controlled component or components as the principal element of the goods being procured.

12. What situations are covered by the exemptions under the Sanctions Regulation?

Last update: 2 October 2023

Articles 2(3) and 2a(3) of the Sanctions Regulation provide for six limited exemptions from the export restrictions provided that certain conditions and requirements are fulfilled, i.e. the use of the exemption is declared to the customs authorities and a notification is made the first time it is used. These exemptions apply to:

• humanitarian purposes, health emergencies, the urgent prevention or mitigation of an event likely to have a serious and significant impact on human health and safety or the environment or as a response to natural disasters;

• medical or pharmaceutical purposes;

• temporary export of items for use by news media;

• software updates;

• use as consumer communication devices; or

• personal use of natural persons travelling to Russia or members of their immediate families travelling with them, and limited to personal effects, household effects, vehicles or tools of trade owned by those individuals and not intended for sale.

For exemptions related to transit through Russia, please check question 42.

13. What situations are covered by the derogations with requirement of authorisation under the Sanctions Regulation?

Last update: 2 October 2023

Article 2(4) of the Sanctions Regulation provides for eight derogations where an authorisation must be requested from the competent authority. Until the authorisation is granted, the export of the item is prohibited. The derogations cover situations where the item is intended for:

(a) cooperation between the Union, the governments of Member States and the government of Russia in purely civilian matters;

(b) intergovernmental cooperation in space programmes;

(c) the operation, maintenance, fuel retreatment and safety of civil nuclear capabilities, as well as civil nuclear cooperation, in particular, in the field of research and development;

(d) maritime safety;

(e) civilian non-publicly available electronic communications networks which are not the property of an entity that is publicly controlled or with over 50% public ownership;

(f) the exclusive use of entities owned, or solely or jointly controlled by a legal person, entity or body which is incorporated or constituted under the law of a Member State or of a partner country;

(g) diplomatic representations of the Union, Member States and partner countries, including delegations, embassies and missions; and

(h) ensuring cyber-security and information security for natural and legal persons, entities and bodies in Russia except for its government and undertakings directly or indirectly controlled by that government.

Article 2a(4) of the Sanctions Regulation provides for nine derogations where an authorisation must be requested from the competent authority. Until the authorisation is granted, the export of the item is prohibited. The derogations cover situations where the item is intended for:

• cooperation between the Union, the governments of Member States and the government of Russia in purely civilian matters;

• intergovernmental cooperation in space programmes;

• the operation, maintenance, fuel retreatment and safety of civil nuclear capabilities, as well as civil nuclear cooperation, in particular, in the field of research and development;

• maritime safety;

• civilian non-publicly available electronic communications networks which are not the property of an entity that is publicly controlled or with over 50% public ownership;

• the exclusive use of entities owned, or solely or jointly controlled by a legal person, entity or body which is incorporated or constituted under the law of a Member State or of a partner country;

• diplomatic representations of the Union, Member States and partner countries, including delegations, embassies and missions;

• ensuring cyber-security and information security for natural and legal persons, entities and bodies in Russia except for its government and undertakings directly or indirectly controlled by that government; and

• exclusive use and under the full control of the authorising Member State and in order to fulfil its maintenance obligations in areas which are under a long-term lease agreement between that Member State and the Russian Federation.

Article 12b of the Sanctions Regulation provides for a temporary derogation strictly necessary for the divestment from Russia or the wind-down of business activities in Russia subject to the fulfilment of certain conditions. Request for authorisations under this derogation can take place until 31 December 2023.

For contracts concluded before 26 February 2022, please check questions 29 to 32. For situations with individuals or entities listed in Annex IV, please check question 20. For derogations related to transit through Russia, please check question 43.

14. How can the exporter demonstrate conclusively that one of the exemptions or derogations applies to its situation?

Last update: 16 March 2022

It is for the competent authority to determine the necessary documentation that might be useful to assess and verify that the conditions for exemptions or derogations are met. This documentation may include contracts, intergovernmental agreements, and declarations from the exporter (self-declaration).

15. The exemption under Article 2(3)(b) and Article 2a(3)(b) can apply under the condition that the goods and technology are intended for non-military use and for a non-military end-user. What does that mean?

Last update: 10 October 2022

The exemptions in Articles 2(3) and 2a(3) allow exports of dual-use and advanced technologies intended for humanitarian purposes, health emergencies and medical purposes from the relevant restrictions, as long as such exports are destined for non-military use and for a non-military enduser. Therefore, where the items are destined for a civilian facility as the end-user, the exemption could apply unless there are reasonable grounds to believe that the items could be diverted to a military use or end-user.

16. Can you explain in more detail how exemptions and derogations operate concerning the exports of Dual-use items and ‘Advanced Technology’ items?

Last update: 10 October 2022

The Sanctions Regulation prohibits the sale, supply, transfer or export, or the related provision of technical and financial assistance, of goods or technology to military end users in Russia, for military end uses and users listed in Annex IV to the Sanctions Regulation.

This covers both Dual-use items (listed in Annex I of the EU Dual-Use Regulation) and ‘Advanced Technology’ items (listed in Annex VII to the Sanctions Regulation).

In relation to potential exports to non-military end-users not listed in Annex IV to the Sanctions Regulation or for non-military end uses of those goods and technology, the following applies:

• For Dual-use items listed in Annex I to the EU Dual-Use Regulation or under authorisation requirement due to the application of a catch-all clause:

o if the intended end-use falls under the scope of the exemptions listed in Article 2(3) (see under question 12), it is not necessary to seek an authorisation pursuant to the Sanctions Regulation, but the exporter shall comply with the requirements pursuant to the EU Dual-Use Regulation. In addition, the Sanctions Regulation requires the exporter to declare in the customs declaration that the items are being exported under the relevant exemption and notify the competent authority of the Member State where the exporter is resident or established when they export for the first time using the relevant exemption within 30 days from the date when the first export took place. The national competent authorities will monitor the use of exemptions with a view to preventing any risk of circumvention of the measures. o if the intended end-use falls under the scope of any of the eight activities listed in Article 2(4) (see under question 13), the exporter shall apply for an authorisation and a case-by-case assessment is made by the competent authority of the Member State where the exporter is resident or established. In addition, the exporter shall comply with the requirements pursuant to the EU Dual-Use Regulation.

o if the export falls under contracts concluded before 26 February 2022, please check questions 29-32.

• For ‘Advanced Technology’ items as listed in Annex VII to the Sanctions Regulation:

o if the intended end-use falls under the scope of the eight exemptions listed in Article 2a(3) (see under question 12), it is not necessary to seek an authorisation pursuant to the Sanctions Regulation. The Sanctions Regulation requires the exporter to declare in the customs declaration that the items are being exported under the relevant exemption and notify the competent authority of the Member State where the exporter is resident or established when they export for the first time using the relevant exemption within 30 days from the date when the first export took place.

The national competent authorities will monitor the use of exemptions with a view to preventing any risk of circumvention of the measures.

o if the intended end-use falls under the scope of activities listed in Article 2a(4) (see

under question 13), the exporter shall apply for an authorisation by the competent authority of the Member State where the exporter is resident or established.

o if the export falls under contracts concluded before 26 February 2022, please check questions 29-32.

In addition, as regards aviation and space industry items, please see question 4, which confirms that the derogations and exemptions above are not available for those sectors except if they are intended for intergovernmental cooperation in space programmes.

17. What rules and procedures apply to the authorisations pursuant to the Sanctions Regulation?

Last update: 16 March 2022

Authorisations pursuant to Articles 2, 2a and 2b are processed by the competent authorities listed in Annex I to the Sanctions Regulation and follow the rules and procedures laid down in the EU Dual-Use Regulation, which applies mutatis mutandis.

18. I am an exporter of cyber-security and information security items, such as software, do I need to apply for a licence under the Sanctions Regulation each time I make a software available to my Russian customers and provide updates to them?

Last update: 10 October 2022

The Sanctions Regulation applies “without prejudice” – i.e. in parallel – to the EU Dual-Use Regulation (EU) 2021/821. Exporters must ensure they comply with both regulations.

Consequently, the export of dual-use items might require an authorisation under the EU DualUse Regulation and, where a derogation applies under the Sanctions Regulation, also under that regulation. In case of doubt, exporters should contact the competent authority of the Member State where the exporter is resident or established.

For authorisations for goods and technology listed in Annex VII to the Sanctions Regulation, the rules and procedures laid down in the EU Dual-Use Regulation apply, mutatis mutandis. This means, for example, that the competent authority of the Member State where the exporter is resident or established may decide to grant a global export authorisation, as defined in the EU Dual-Use Regulation7, for the export of cyber-security and information security items in Annex VII. Such authorisation could cover, for instance, the export of a specified item and subsequent updates (for example bug-fixes, malware fingerprint data) and/or upgrades (unlocking additional functionalities) to multiple end-users in Russia, recognising that some exporters of cybersecurity items may have large numbers of customers.

19. Can my company perform remote software configuration updates, software monitoring and software log analysis telecommunication and Information Security equipment installed in Russian sites of customers?

Last update: 10 October 2022

Sale, supply, transfer or exports of dual-use and advanced technology items (as well as related provision of technical assistance) intended for software updates are allowed under the exemption of Article 2(3)(d) and 2a(3)(d) of the Sanctions Regulation. EU companies can provide remote software interventions, including software configuration updates, software monitoring and software log analysis, related to dual-use goods and technology and to certain goods and technology listed in annex VII of the Sanctions Regulation for non-military use and for a nonmilitary end-user. As indicated in the relevant provisions, the exporter shall notify the competent authority of the Member State where the exporter is resident or established of the first use of the relevant exception within 30 days from the date when the remote software intervention is provided.

20. Is it still possible to export to the individuals or entities listed in Annex IV? What rules apply to the subsidiaries of these entities or entities controlled by them?

Last update: 10 October 2022

Stricter conditions apply for exports to certain end-users connected to Russia’s defence and industrial base. With respect to these individuals and entities listed in Annex IV to the Sanctions Regulation, exemptions do not apply and only some very limited possibilities of authorisation by the competent authorities apply for the urgent prevention or mitigation of an event likely to have a serious and significant impact on human health and safety or the environment. With regard to these individuals and entities, contracts concluded before 26 February 2022 may be executed, subject to an authorisation by the competent authority, but trade must stop until such authorisation is granted. Such authorisations should have been requested before 1 May 2022.

Export restrictions to these entities do not apply if the items concerned are not listed in Annex VII to the Sanctions Regulation (‘Advanced technology’ items) nor listed in Annex I to the EU Dual-Use Regulation or subject to catch-all clauses under the EU Dual-Use Regulation. This is without prejudice to any other export restrictions that might be in place under the Sanctions Regulation, other rules or regulations.

EU exporters must also ensure that the covered items do not reach the listed entities indirectly (via those entities’ non-listed subsidiaries or other entities they control, or via an intermediary). The sale, supply, transfer or export of covered items to a third-party intermediary is also prohibited, if the items would reach the listed entity. In all situations, EU exporters should perform adequate due diligence on their business partners and the final destination of the goods.

EU exporters are furthermore prohibited from participating, knowingly and intentionally, in activities the object or effect of which is to circumvent these export restrictions.

21. What if the exports of Dual-use or ‘Advanced Technology’ items do not appear to fall within the exemptions or the derogations, can I still apply for an authorisation?

Last update: 16 March 2022

As a general rule, if you fall outside these situations there is no point in applying for an authorisation.

For the conditions applicable to the fulfilment of existing contracts, please check questions 29-32.

22. How did you select the items included in your list of ‘Advanced Technology’ products?

Last update: 16 March 2022

The items included in the list of products in Annex VII were selected on the basis that they may contribute, directly or indirectly, to enhancing Russia’s military and technological capacity. They were also selected in cooperation with our partner countries.

23. How should the term ‘other services’ be interpreted?

Last update: 9 June 2022

The term “other services” is comprehensive. It covers all services that are "related to the goods and technology […] and to the provision, manufacture, maintenance and use of these goods and technology, directly or indirectly to any natural or legal person, entity or body in Russia, or for use in Russia”. It is for the EU Company to ensure that the provision of services in question is not related to the sanctioned good or to the provision, manufacture, maintenance and use of this sanctioned good.

PRACTICAL OPERATION OF THE EXPORT RESTRICTION OF DUAL-USE AND 'ADVANCED TECHNOLOGY' ITEMS FOR BUSINESSES

24. How can I verify/demonstrate that the technical specifications of the items I want to export do or do not fall under the Annex with ‘Advanced technology’ items?

Last update: 16 March 2022

Items in Annex VII are listed on the basis of their description and their technical parameters. When exporting to Russia and your items are subject to controls, you might be asked to provide any document needed to identify your item, and useful to its identification and classification, including, for example, technical datasheet where characteristics and technical parameters of your item are listed.

25. What is the “indicative temporary correlation table” linking customs codes to items in Annex VII?

Last update: 10 October 2022

Annex VII to the Sanctions Regulation listing ‘Advanced Technology’ items does not contain commodity (customs) codes.

Annex I of this FAQ includes, for purely informative purposes, a Correlation Table with references correlating the goods in Annex VII to the Sanctions Regulation with the corresponding commodity codes as defined under the rules of the Common Customs Tariff and Combined Nomenclature (CN). This is provided as courtesy to economic operators to help them in the identification and classification of goods in Annex VII that are subject to the measures set out in Article 2a(1) and 2b(1) of the Sanctions Regulation. The corresponding 8-digit CN codes provide a non-binding guide for economic operators to detect and identify the goods that they are declaring. It is not binding and is provided without prejudice to all the obligations of the economic operator from the point of view of export control and sanctions to be checked at the moment of the lodging of the customs declaration.

It should be noted that, while the commodity codes support economic operators in their compliance efforts, an additional technical assessment is necessary for drawing conclusions as to whether a good is subject to the export restrictions. This additional technical assessment is often required as, in most cases, there is not a perfect match between the description of the goods in Annex VII and the description of corresponding commodity codes.

The commodity codes are taken from the Combined Nomenclature. This is defined in Article 1(2) of Council Regulation (EEC) No 2658/87 and as set out in Annex I thereto, which are valid at the time of publication of the Sanctions Regulation.

26. Please clarify the term “tractor” in X.A.VII.001. Is it tractor for use in agriculture or does it refer to heavy trucks?

Last update: 16 March 2022

The term ‘tractor’ (Item X.A.VII.001.b in Annex VII) concerns off highway wheel tractors, which include agriculture tractors as long as they meet the technical parameters required in this control.

Heavy trucks understood as road trucks for semi-trailers are covered by item X.A.VII.001.c in the same annex.

27. How do I apply for a derogation concerning dual-use items?

Last update: 16 March 2022